Some Known Incorrect Statements About Paul Burrowes - Realtor David Lyng Real Estate

Table of ContentsThe Best Strategy To Use For Paul Burrowes - Realtor David Lyng Real EstateNot known Details About Paul Burrowes - Realtor David Lyng Real Estate Paul Burrowes - Realtor David Lyng Real Estate for DummiesThe Main Principles Of Paul Burrowes - Realtor David Lyng Real Estate The Basic Principles Of Paul Burrowes - Realtor David Lyng Real Estate

Divulge your license: The reality that you hold a genuine estate certificate should be divulged to buyers and sellers, even when you are acquiring or selling for yourself, or when doing so via another agent. Below are the basic steps for getting a genuine estate certificate: Research the demands for your state. Pay a cost to schedule and take the state real estate examination.Send to fingerprinting, a background check, and a criminal history report (https://linktr.ee/paulbrealtor). Pay the state realty certificate charge. Discover a broker to hire you and activate your permit. Join the regional genuine estate association to get to the MLS. Attend any positioning and new-hire classes that your brand-new broker or property organization might require.

The Facts About Paul Burrowes - Realtor David Lyng Real Estate Revealed

Investor might find that obtaining a property permit is an outstanding means to develop an additional income stream, locate more bargains, and discover more about the service of realty investing.

Today, I'm thrilled to share a visitor message with you that was created by Chad Carson from . This is a message I have actually been intending to compose for years however since I'm not a real-estate financier, I really did not have the knowledge or experience to do it. Fortunately, Chad has both (he's been a permanent real-estate capitalist for nearly 15 years) and was kind sufficient to create the ridiculously interesting post you're regarding to review.

An organization companion and I dove right into genuine estate investing in 2003 and never looked back. As fledgling genuine estate investors, we had 2 difficulties.

Often we offered these in as-is condition to various other capitalists (aka wholesaling). To build wide range and retire early, we likewise began purchasing actual estate investments.

Along the way, we acquired and marketed hundreds of buildings. And today we still own 90 rental systems in and around the tiny university town of Clemson, South Carolina.

Paul Burrowes - Realtor David Lyng Real Estate for Dummies

If you have a normal work to pay the bills, you can complete incredible monetary results with just a few investment residential or commercial properties. And the real estate strategies I have actually made use of work quite possibly together with various other investment strategies like stock index fund investing as shown by the wonderful JL Collins.

So, allow's very first take a look at just how you generate income in property investing. Just remember that realty is an I.D.E. Scotts Valley, California, homes for sale.A.L. investment: Normal money circulation from leas or passion repayments. I consistently see unleveraged returns of 5-10% from this method of earning money. With reasonable take advantage of, it's possible to see these returns jump to the 10-15% array or better.

Active appreciation occurs when you force the value higher over a shorter period of time, like with a home remodel. Lots of capitalists make use of debt utilize to acquire real estate.

Paul Burrowes - Realtor David Lyng Real Estate - Truths

However the earnings was outstanding. And the depreciation protected several of the revenue from tax obligations. One more investment was a much more costly solitary family members house in a fantastic area. The internet rental fee after expenditures barely paid the home mortgage (no earnings). My equity constructed up promptly because the lending amortized quickly.

Mr. T Then & Now!

Mr. T Then & Now! Jennifer Love Hewitt Then & Now!

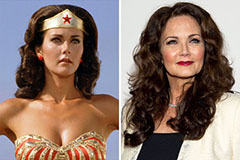

Jennifer Love Hewitt Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!